Guest checkout vs account: Which converts better? Compare 5 checkout strategies with research from Baymard, Cornell, and industry studies on conversion rates and repeat purchases.

Guest checkout vs account: Which converts better? Compare 5 checkout strategies with research from Baymard, Cornell, and industry studies on conversion rates and repeat purchases.

Your checkout page is the final gate between browsing and buying. Yet one decision—whether to require account creation or allow guest checkout, can single-handedly determine whether a customer completes their purchase or abandons their cart.

The average ecommerce site sees a cart abandonment rate of 70.22%.[1] While some abandonment is unavoidable (43% of shoppers report they were “just browsing”),[1] a significant portion is driven by checkout friction, friction that strategic design decisions can eliminate.

This article examines five checkout strategies across multiple factors:

Comparison Factors:

Based on research from Baymard Institute, Cornell University, Ecommpay/IMRG, and industry benchmarks, we’ve identified which approaches deliver the strongest performance across different business scenarios.

| Strategy | First-Time Friction | Conversion Impact | Repeat Purchase | Speed | Data Capture | Best For |

| Guest Checkout Only | Very Low | High for new customers | Low (20-30% repeat rate) | Fast | Minimal | New brands, impulse buys |

| Hybrid (Guest + Optional Account) | Low | Moderate-High | Moderate (higher with incentives) | Moderate | Selective | Most DTC brands |

| Account Required | Very High | Low (drives 19% abandonment)[1] | High (64% convert when returning)[3] | Fast for returns | Comprehensive | Subscription, B2B |

| Guest with Post-Purchase Account | Very Low | High initially | Moderate-High | Fast | Progressive | Growth-stage brands |

| One-Click Express Checkout | Very Low (for wallet users) | Very High (67% with 4+ options)[3] | Very High (28.5% spend increase)[2] | Very Fast | Moderate-High | High-volume retailers |

Guest checkout removes all barriers between a customer and completing their order. Customers enter only the essential information—shipping address, email, and payment details—without creating passwords or usernames.

This approach excels when speed and simplicity are your primary conversion drivers. The data is clear: Baymard Institute’s research shows that 19% of US shoppers have abandoned orders specifically because “the site wanted me to create an account.”[1] For brands selling impulse-buy products, seasonal items, or targeting first-time customers, eliminating this barrier is critical.

However, pure guest checkout comes with trade-offs. Without accounts, you sacrifice the infrastructure to build robust customer profiles, track purchase history automatically, or create seamless reorder experiences. Every subsequent purchase requires customers to re-enter their information, which creates friction for your most valuable segment: repeat buyers.

Industry data shows that the average ecommerce repeat purchase rate hovers around 20-30%.[5] Guest-only checkouts typically fall at the lower end of this range, as there’s no mechanism to encourage or streamline return purchases.

Key Characteristics:

Summary of Market Research “Fast and frictionless” for new customers, but “lacks the infrastructure” to build long-term customer relationships or optimize for repeat purchases.

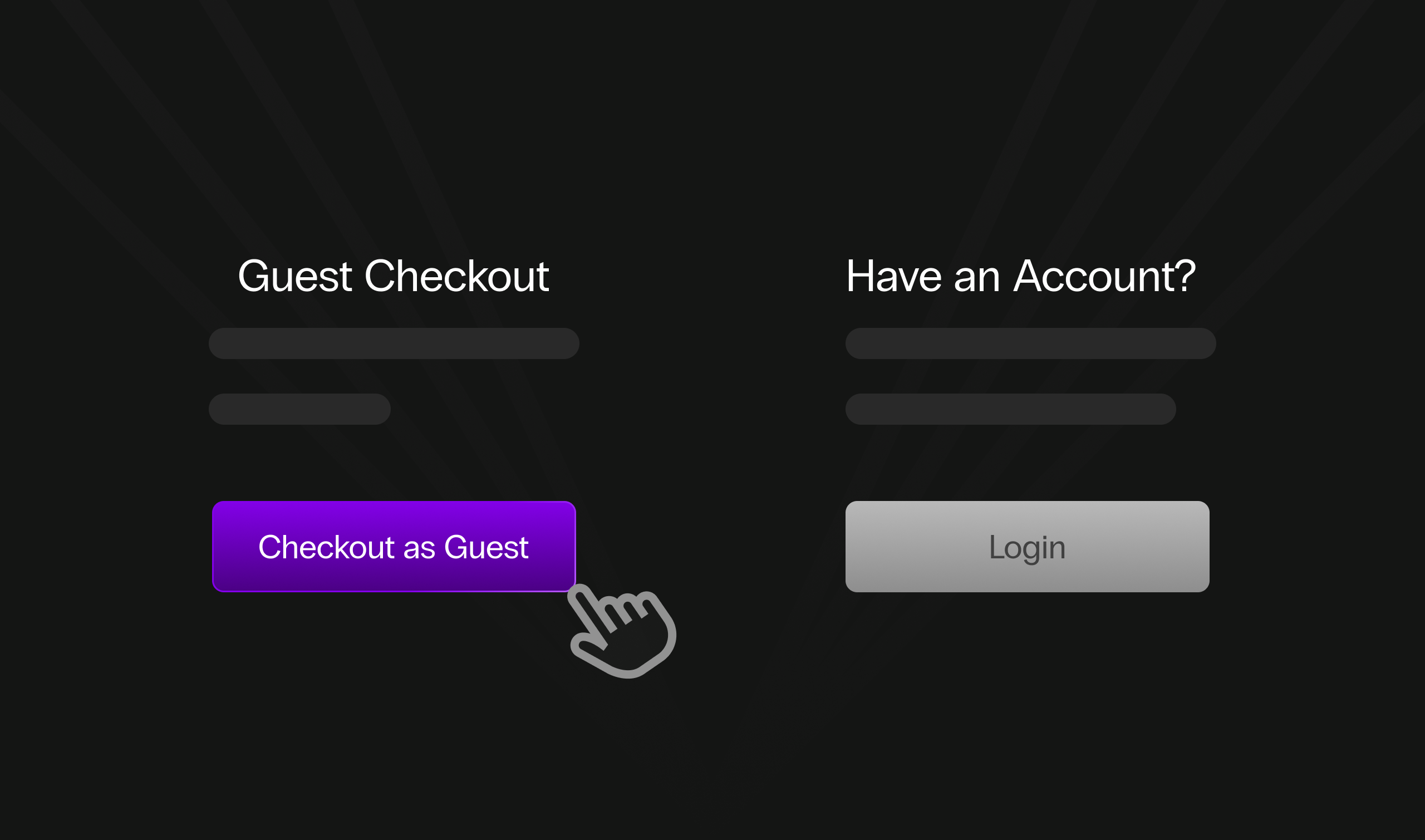

The hybrid model offers customers a choice: check out as a guest or create an account for added benefits. This middle-ground strategy presents options at checkout: “Guest,” “Returning Customer,” or “Create Account.”

Research from Ecommpay and IMRG shows nuanced performance: guest shoppers generate 59% of all orders but convert at only 52%, while registered customers convert at 64%.[3] This suggests that while most customers prefer guest checkout, those who do create accounts demonstrate higher purchase intent and completion rates.

The challenge lies in execution. Baymard Institute’s benchmark reveals that 62% of sites fail to make guest checkout sufficiently prominent.[1] If the account option appears too dominant or the guest path isn’t immediately obvious, conversion rates drop as customers perceive account creation as required—even when it isn’t.

Key Characteristics:

Summary of Market Research “Offers choice and flexibility” when implemented correctly, but “requires careful UX design” to ensure guest checkout remains prominent and account benefits are clearly communicated.

Mandatory account creation forces every customer to register before completing their first purchase. This approach prioritizes long-term customer relationship building over immediate conversion.

The data reveals the cost of this strategy: Baymard Institute’s research shows that 19% of US online shoppers have abandoned checkout specifically because a site required account creation.[1] For general ecommerce, this represents a significant conversion barrier.

However, account-required checkouts work in specific scenarios: subscription services, member-only retailers, B2B platforms, or brands where customer data and personalization are core to the business model. When customers expect to return frequently or when account creation unlocks significant value (exclusive pricing, order management, saved preferences), the friction becomes acceptable, even expected.

Ecommpay/IMRG data shows that registered customers convert at 64% compared to 52% for guest shoppers,[3] demonstrating that once customers clear the initial hurdle, they exhibit stronger purchase behavior.

Key Characteristics:

Summary of Market Research “Builds deep customer relationships and rich data sets,” but “creates significant barriers” that deter casual browsers and first-time shoppers from converting.

This strategy lets customers check out as guests, then offers account creation after the purchase is complete. Some platforms automatically create accounts using the customer’s checkout email, sending a password-setup link post-purchase.

This approach captures low-friction initial conversion while building the infrastructure for customer accounts over time. Customers who enjoy their first purchase are more likely to set up an account when invited after a positive experience, rather than being forced to register before they’ve experienced your brand’s value.

The strategy addresses the fundamental tension in the data: guest checkouts convert more first-time buyers (avoiding the 19% abandonment from forced accounts),[1] while registered customers show stronger repeat behavior (64% vs 52% conversion).[3] Post-purchase account creation attempts to capture both benefits sequentially.

The key to success is timing and incentive. Post-purchase account invitations should highlight tangible benefits: “Track your order, save your details for one-click next-time checkout, and get 15% off your next purchase.”

Key Characteristics:

Summary of Market Research “Optimizes for both immediate conversion and long-term customer value,” and “removes friction while building” robust customer databases over time.

Express checkout options like Shop Pay, Apple Pay, Google Pay, and integrated wallet solutions allow returning customers to complete purchases with a single tap. Customer payment and shipping information is securely stored and auto-filled.

The research on express checkout is compelling. Cornell University’s study found that customers who adopted one-click checkout increased their spending by 28.5% on average, raised purchase frequency by 43%, and increased items purchased by 36%.[2] They also visited the website 7% more often and viewed 9.3% more pages per visit.[2]

Ecommpay/IMRG data reinforces this: retailers offering four express checkout methods achieve 67% conversion rates, while those with a single option convert at 54%. Sites without express checkout options report 52% conversion rates.[3] Research from LimeSpot indicates that offering multiple express checkout options can boost conversion rates by 10-20% compared to sites offering only standard credit card fields.[4]

The limitation: one-click checkout requires either previous purchase history or digital wallet setup. First-time customers still need a fallback option. Additionally, brands must integrate with third-party wallet providers, which can involve transaction fees and technical complexity.

Key Characteristics:

Summary of Market Research “Delivers unmatched speed and convenience for repeat buyers,” and “significantly increases customer lifetime value” but requires integration investment and offers limited value for first-time acquisition.

Based on the research and data compiled, checkout strategies perform differently depending on your business model:

Most checkout platforms force you to choose between guest checkout simplicity and express checkout speed. Krepling Pay eliminates that trade-off.

Our pre-built, white-labeled checkout solution is optimized for both guest and express transactions simultaneously. Customers can complete purchases as guests using our streamlined 6-field process, and they have the option to save payment details via digital wallets for one-click checkout on future visits—no forced account creation required.

The research validates this dual approach: guest checkout prevents the 19% abandonment from forced accounts,[1] while express options drive 67% conversion rates and 28.5% spending increases.[2][3] Krepling Pay delivers both benefits in a single, unified checkout experience.

This optimization delivers measurable results:

Krepling Pay is built for DTC brands in Fashion, Health & Beauty, and Food & Beverage generating $500,000 to $50 million annually, businesses that need enterprise-grade checkout performance without enterprise-level complexity.

Ready to optimize your checkout for both speed and conversion? Schedule a checkout audit with Krepling Pay to see how our solution compares to your current setup.

Guest checkout vs account: Which converts better? Compare 5 checkout strategies with research from Baymard, Cornell, and industry studies on conversion rates and repeat purchases.

Learn how Krepling Pay can power your business—whether you’re enhancing your existing checkout or launching a fully embedded, end-to-end retail experience.