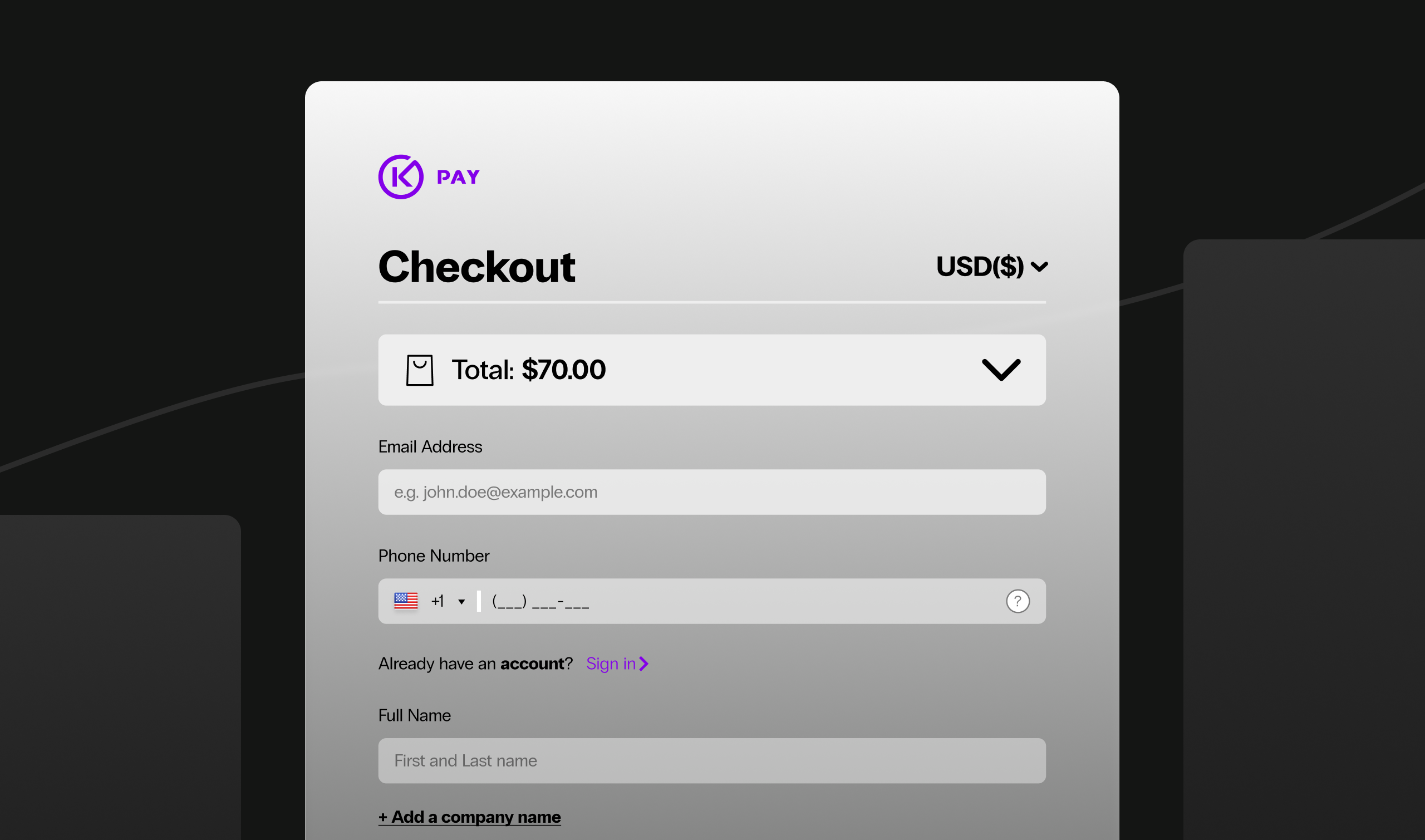

1. Krepling Pay, for platform-agnostic speed optimization

Krepling Pay emerged as the leader in our analysis for merchants who prioritize checkout speed without platform lock-in. Unlike solutions that tie you to Shopify or WordPress, Krepling’s white-label checkout works across any ecommerce platform—Shopify, Magento, WooCommerce, BigCommerce, or custom builds.

The platform’s streamlined approach condenses checkout into a single-page, 6-field experience. Where traditional checkouts force customers through 12-15 fields across multiple pages, Krepling eliminates the friction. Testing with beta merchants showed checkout completion 44% faster than category averages, translating to a 31% conversion lift versus traditional payment gateways.

The key differentiator is implementation simplicity. Setup takes approximately 15 minutes with no development work required. The pre-built solution includes both express and guest checkout options without requiring account creation—a common abandonment trigger with Apple Pay, PayPal, or Google Pay alternatives. Because it’s built directly into your branded checkout rather than redirecting to third-party pages, customers never leave your site.

Location: San Francisco, CA

Year Founded: 2019-2020

Price Range: $ (2.1%-2.7% + 30¢, flat-fee pricing)

Setup Time: ~15 minutes

Average Review Score: 4.9/5.0

Platform Support: Platform-agnostic (works with any ecommerce system)

Services Offered: White-label checkout, express & guest checkout optimization, platform-agnostic integration, checkout audits

Summary of Online Reviews:

Merchants consistently praise “implementation speed” and “immediate conversion improvements,” noting “zero development burden” and “platform flexibility” as standout benefits. The primary consideration centers on newer market presence compared to established alternatives.

2. Shop Pay, for Shopify ecosystem dominance

Shop Pay represents Shopify’s answer to checkout optimization, and the numbers validate the approach. The solution claims up to 50% better conversion compared to guest checkout, driven by stored customer information that enables true one-tap purchasing.

The power of Shop Pay extends beyond individual stores. With over 150 million shoppers already using Shop Pay across the network, many customers arriving at your Shopify store already have payment information saved. This network effect creates instant familiarity and reduces friction to a single tap for repeat Shop Pay users.

Integration is seamless for Shopify merchants—Shop Pay activates automatically when you enable Shopify Payments. The solution includes Shop Pay Installments for buy-now-pay-later functionality, order tracking through the Shop app, and 9% higher repurchase rates for customers using the Shop app.

The obvious limitation: you must use Shopify. Merchants on WooCommerce, Magento, BigCommerce, or custom platforms cannot access Shop Pay. Additionally, Shop Pay’s fees are tied to your Shopify plan tier, ranging from 2.4% to 2.9% plus 30¢ per transaction.

Location: Ottawa, Canada

Year Founded: 2017 (as part of Shopify Payments)

Price Range: $$ (Included with Shopify Payments: 2.4%-2.9% + 30¢)

Setup Time: Instant (automatic with Shopify Payments)

Average Review Score: 4.7/5.0

Platform Support: Shopify exclusive

Services Offered: One-tap checkout, Shop Pay Installments, Shop app integration, order tracking, fraud analysis

Summary of Online Reviews:

Shopify merchants value “frictionless setup” and “network effect benefits,” with 43% of buyers already using Shop Pay as their preferred method. Some note “platform lock-in” as a consideration for businesses planning multi-platform expansion.

3. Bolt, for enterprise checkout optimization

Bolt targets mid-market to enterprise retailers seeking checkout optimization with fraud protection guarantees. The platform offers one-click checkout powered by a shopper network of tens of millions of saved profiles, similar to Shop Pay’s approach but platform-agnostic.

The solution’s standout feature is its 100% fraud chargeback guarantee—Bolt covers all fraud-related chargeback costs, a rare offering in the payment space. The fraud detection combines machine learning with human review, setting it apart from purely algorithmic systems that often block legitimate transactions.

Bolt integrates with 44 different platforms and services, including Shopify, Magento, BigCommerce, and custom builds. The unified dashboard consolidates transaction management, customer behavior analytics, and 24/7 support access via live chat, email, or phone.

However, pricing remains opaque. While Bolt publicly advertises 2.1% + 30¢ transaction fees, actual pricing is quote-based and varies significantly based on sales volume, fraud risk profile, and negotiated terms. Implementation requires 2-4 hours for basic setups, more for complex configurations. Some reviewers cite settlement reporting as less detailed than desired for reconciliation purposes.

Location: San Francisco, CA

Year Founded: 2014

Price Range: $$$ (Quote-based; advertised 2.1% + 30¢)

Setup Time: 2-4 hours

Average Review Score: 4.3/5.0

Platform Support: 44+ integrations including major platforms

Services Offered: One-click checkout, fraud protection with chargeback guarantee, shopper network, virtual terminal, analytics dashboard

Summary of Online Reviews:

Enterprise users appreciate “fraud protection guarantee” and “smooth checkout experience,” though smaller merchants cite “opaque pricing” and “higher cost point” compared to alternatives.

4. Shopify Payments, for native Shopify integration

For merchants operating exclusively on Shopify, Shopify Payments delivers seamless integration with the platform’s complete ecosystem. The gateway synchronizes automatically with inventory, orders, analytics, and customer data, eliminating the data fragmentation that occurs with third-party payment processors.

The solution includes Shop Pay (reviewed separately above), competitive processing rates that decrease with higher-tier plans, and multi-currency support for international selling. Merchants avoid the 2% transaction fee Shopify charges for using third-party gateways, making it cost-effective for Shopify-committed businesses.

Shopify Payments also offers POS integration for omnichannel retailers, unified reporting across online and in-person sales, and built-in fraud analysis. The processing rates range from 2.4% (Advanced Shopify plan) to 2.9% (Basic plan), plus 30¢ per transaction.

The platform lock-in is complete: you cannot use Shopify Payments on WooCommerce, Magento, or other platforms. Certain business categories also fall under Shopify’s restricted products list and cannot use the service. Some merchants report account holds or restrictions during dispute periods.

Location: Ottawa, Canada

Year Founded: 2013

Price Range: $$ (2.4%-2.9% + 30¢ depending on plan)

Setup Time: <1 minute

Average Review Score: 4.4/5.0

Platform Support: Shopify exclusive

Services Offered: Payment processing, Shop Pay, POS integration, fraud analysis, multi-currency support, unified reporting

Summary of Online Reviews:

Merchants value “unified dashboard experience” and “no third-party fees,” with some noting “account holds” and “complete platform dependency” as concerns for certain industries.

5. WooPayments, for WordPress/WooCommerce simplicity

WooPayments offers native integration for WooCommerce stores, eliminating the plugin complications that plague third-party gateway integrations on WordPress. Developed by Automattic (WordPress’s parent company), the solution syncs directly with WooCommerce dashboards for unified order and payment management.

The gateway wraps Stripe’s payment processing technology into WordPress’s admin interface, providing access to Stripe’s capabilities without leaving your dashboard. This includes support for 18+ payment methods (cards, Apple Pay, Google Pay, Link by Stripe), multi-currency functionality across 135+ currencies, and buy-now-pay-later options through providers like Klarna, Afterpay, and Affirm.

WooPayments charges standard industry rates of 2.9% + 30¢ with no monthly fees, setup costs, or hidden charges. Deposits flow directly to merchants’ bank accounts within 2-7 business days depending on country. The built-in analytics provide clear summaries of account activity, recent payouts, and balance tracking across multiple currencies.

The platform serves WooCommerce merchants exclusively—businesses on Shopify, Magento, or custom platforms cannot use WooPayments. The solution doesn’t offer volume discounts for high-performing stores, and payment method diversity (18+) lags behind full-service gateways like Stripe (100+) or Adyen (250+).

Location: San Francisco, CA

Year Founded: 2020

Price Range: $$ (2.9% + 30¢, no monthly fees)

Setup Time: 30-60 minutes

Average Review Score: 4.1/5.0

Platform Support: WordPress/WooCommerce exclusive

Services Offered: Payment processing, multi-currency support (135+), instant deposits, fraud protection, dispute management, express checkout options

Summary of Online Reviews:

WooCommerce users appreciate “seamless WordPress integration” and “no additional plugins required,” with occasional concerns about “limited payment methods” compared to standalone Stripe integration and “platform lock-in” for businesses considering multi-platform expansion.