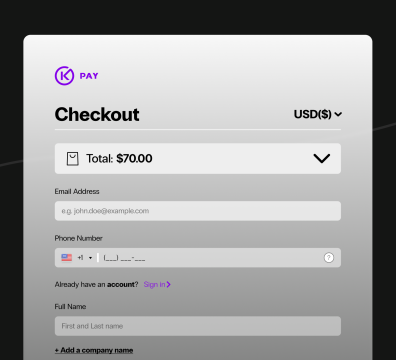

Fast One-Click Checkout: How Speed Impacts Your Bottom Line

Discover how fast one-click checkout increases conversions by 31% on average. Verified data from 15 DTC brands shows 44% faster checkout = 40-50% less abandonment. Calculate your revenue recovery potential with our framework.